April 21, 2023

How About Now? Investment Grade Bonds

Tom O'Shea, CFA

Director of Investment Strategy

Innovator Capital Management

At Innovator, we believe every asset should serve a purpose. When considering adding an asset, it is important to evaluate its impact to the portfolio’s expected return, risk, and liquidity. Investors should also consider the asset’s tax implications and time horizons.

Investment Grade Bonds May Help Manage Risk

Investment grade bonds are issued by corporations that receive the highest ratings from credit rating agencies. Higher credit ratings suggest a lower risk of the issuer defaulting on the coupon payments, and thus lower yields for taking on less risk. Investment grade bonds typically provide lower yields compared to less credit-worthy issues, but higher yields then government and municipal bonds.

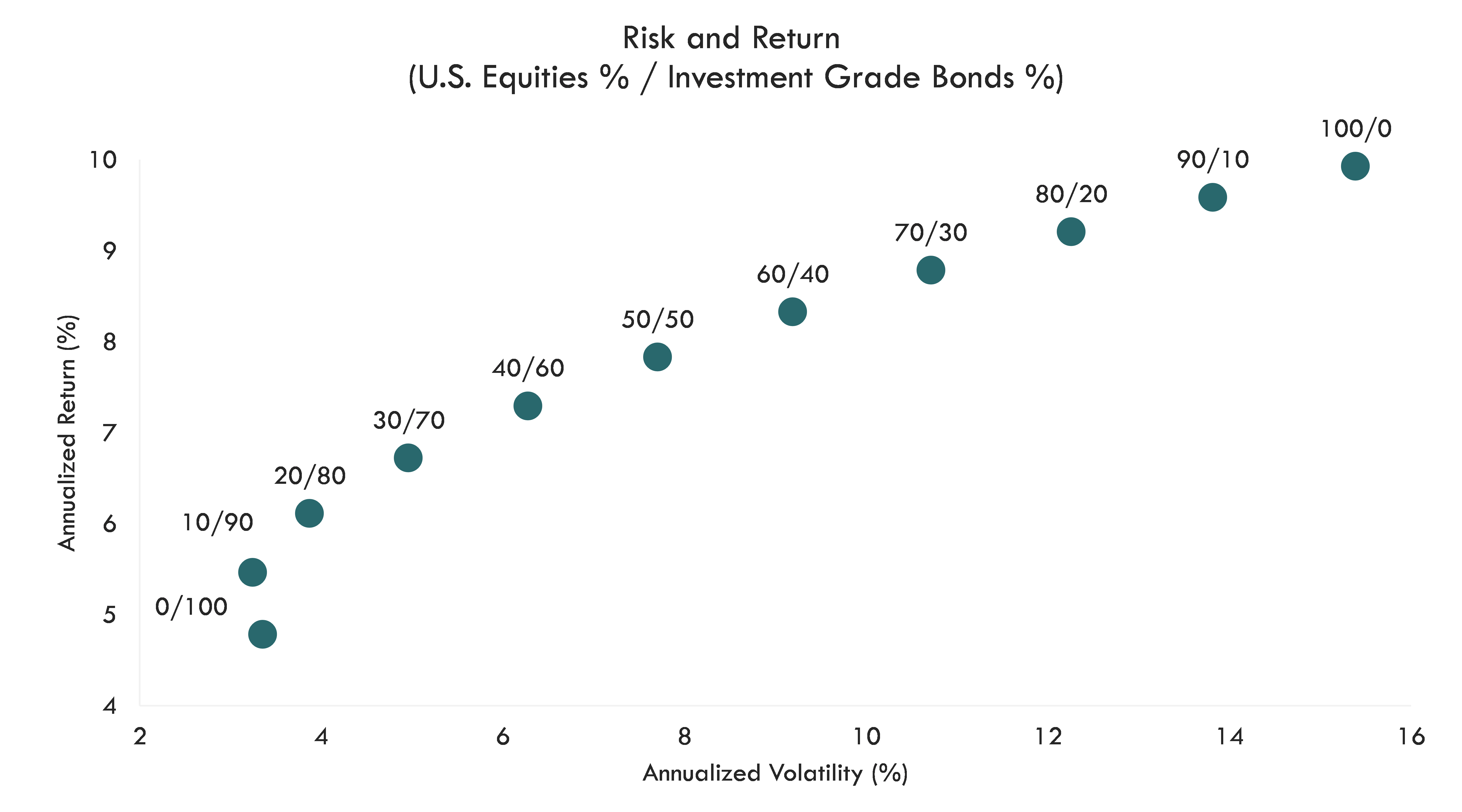

Traditionally, portfolio managers have allocated to investment grade bonds for risk management and income generation. The efficient frontier below highlights various allocation combinations and how an investor could have historically adjusted portfolio weights to investment grade bonds to fit an investor’s risk profile.

Source: Bloomberg L.P., Innovator Research & Investment Strategy. Annualized Return and volatility measured from 3/31/1992 -3/31/2023. U.S. equities = S&P 500. Investment grade bonds = Bloomberg U.S. Aggregate Total Return Value Unhedged USD index. Past performance does not guarantee future results. You cannot invest directly in an index.

Falling Interest Rate Environments Support Allocations to Investment Grade Bonds

During periods of economic distress, portfolio managers often shift portfolio allocations from risk assets to historically less risky assets. Portfolio managers would expect investment grade bonds to fall less or even remain positive while U.S. equities experience drawdowns. In 12-month periods experiencing below median nominal GDP growth, Investment grade bonds returned an average 6.1% vs. above median periods at 3.6%.

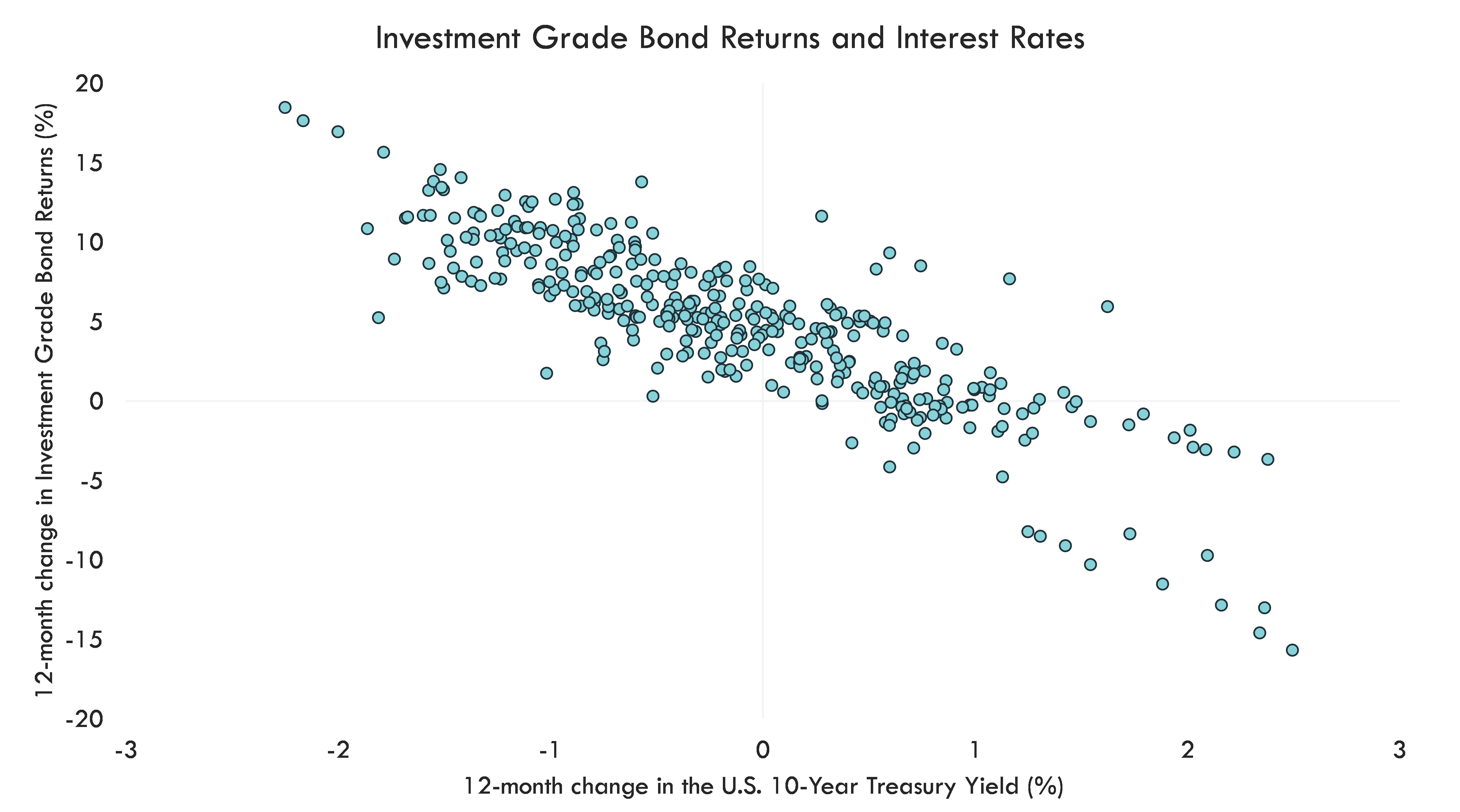

This is particularly relevant given the Federal Reserve’s dual mandate of maintaining stable prices while maximizing employment. They seek to achieve this mandate by adjusting the size of the balance sheet and the policy rate. Policy rate cutting cycles act as a tailwind for investment grade bonds because newly issued bonds will be issued at lower yields making previously issued bonds with a higher yield more attractive. On the flip side, tightening cycles and rising interest rate environments typically lead to worse performance of investment grade bonds. Existing bonds deliver a lower yield relative to newly issued bonds, making them less attractive. The chart below illustrates the inverse relationship between interest rate movements and investment grade bond returns over 12-month rolling periods.

Source: Bloomberg L.P., Innovator Research and Investment Strategy. Investment Grade Bond returns proxied by Bloomberg U.S. Aggregate Bond index. 12-month rolling returns from 3/31/1992 - 3/31/2023. Past performance does not guarantee future results.

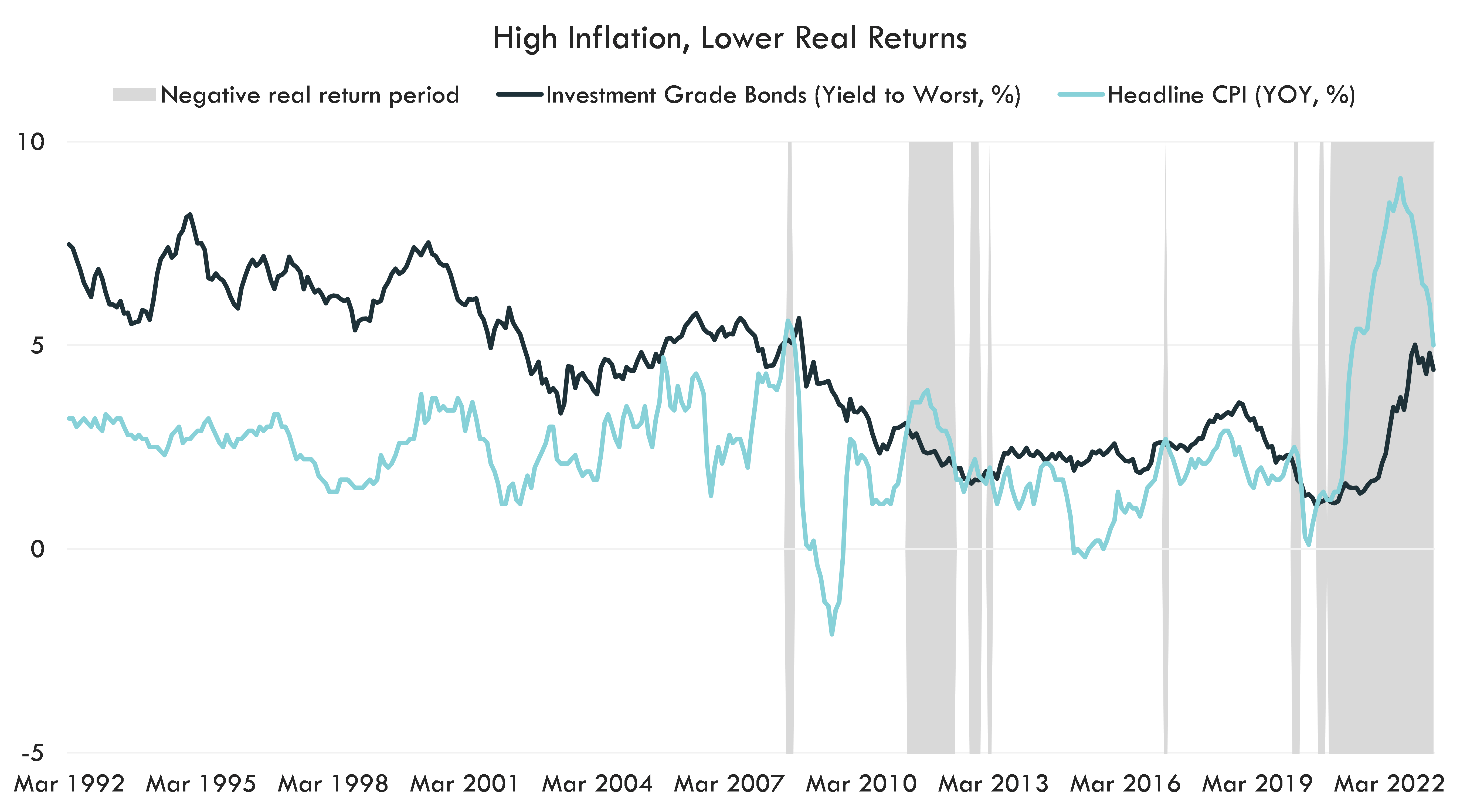

High inflation, rising rates challenge investment grade performance

During the zero-interest rate policy era following the global financial crisis, depressed bond yields forced portfolio managers to invest in riskier assets to meet clients’ return requirements. In contrast, today’s bond yields have climbed to the highest levels in about 15 years after one of the fastest tightening cycles in Fed history; portfolio managers may think they can reduce their allocations to riskier assets and replace with higher yielding investment grade bonds to meet return requirements. However, failing to factor in inflation may lead to lower real returns. Bond yields are the highest since the global financial crisis but inflation is even higher. The current yield to worst on investment grade bonds falls short of the most recent Consumer Price Index reading of 5.0% year-over-year growth.

Source: Bloomberg L.P., Innovator Research and Investment Strategy. Investment Grade Bonds yield to worst are proxied by Bloomberg U.S. Aggregate bond index. Headline CPI is the Headline consumer price index. The yield to worst of a bond is the lowest possible yield that can be received on a bond with an early retirement provision. Data from 3/31/1992 – 3/31/2023.

Current Considerations

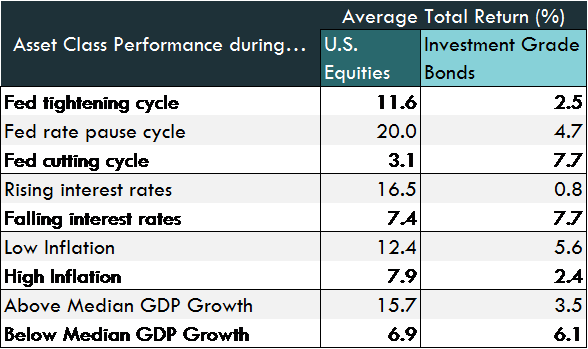

Since peaking at 9.1% in the Summer of 2022, inflation is trending lower. Unfortunately, it’s moving at a pace much slower than investors expected. With inflation well above the Federal Reserve’s 2% target, market participants should examine the historical relationship between elevated prices and investment grade bond returns. Elevated prices have led to lower returns as the table below demonstrates. In 12-month periods where headline CPI rose by 3% or more, investment grade bonds returned an average 2.4% vs. an average 5.6% when CPI increased by less than 3%.

Source: Bloomberg L.P., Innovator Research and Investment Strategy. U.S. equities = S&P 500. Investment Grade Bonds = Bloomberg U.S. Aggregate Bond Index. Average Total figures are calculated over 12-month periods from 3/31/1992 – 3/31/2023. Rising/Falling interest rates measured by U.S 10-year Treasury yield. High inflation is headline CPI greater than 3.0% year-over-year. Above median GDP Growth is 4.7%. Past performance does not guarantee future results.

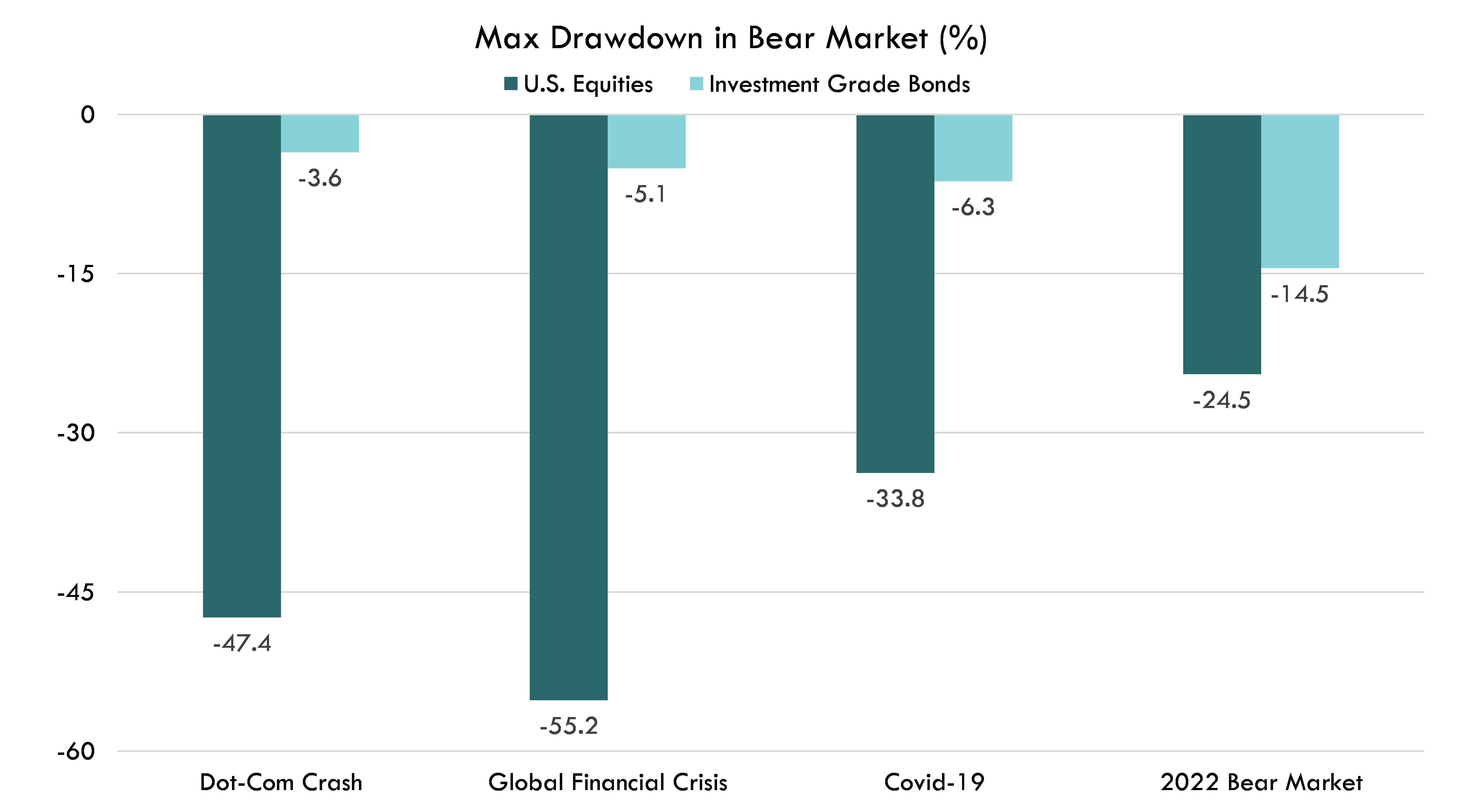

Additionally, high rates and extreme volatility in the bond market following the collapse of Silicon Valley Bank may lead to added uncertainty in fixed income markets. Equities and investment grade bonds have become highly correlated as the asset classes face similar risks. An allocation to investment grade bonds in bear markets would have benefitted an investor in the most recent bear markets, but the correlation of returns is apparent in the bear market beginning in 2022. Periods throughout 2022 saw investment grade bonds decline more than equities.

Source: Bloomberg L.P., Innovator Research and investment Strategy. U.S. Equities = S&P 500. Investment Grade Bonds = Bloomberg U.S. Aggregate Total Return Value Unhedged USD index. Asset class performance dates: Dot-Com Crash (3/24/2000-10/9/2002), Global Financial Crisis (10/9/2007 - 3/9/2009), Covid-19(2/19/2020-3/23/2020), 2022 Bear Market (1/3/2022 - 10/12/2022). Note: 10/12/2022 was the bottom of the 2022 bear market at the time of this report. Past performance does not guarantee future results. You cannot invest directly in an index.

Bottom Line

Investment grade bonds are staples in portfolios as a risk management tool, however the current economic environment may act as a headwind to investment grade returns. Prudent investors may consider complementing their investment grade allocation with less interest-rate and credit-risk sensitive strategies.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.