March 9, 2023

A Laboring 2023

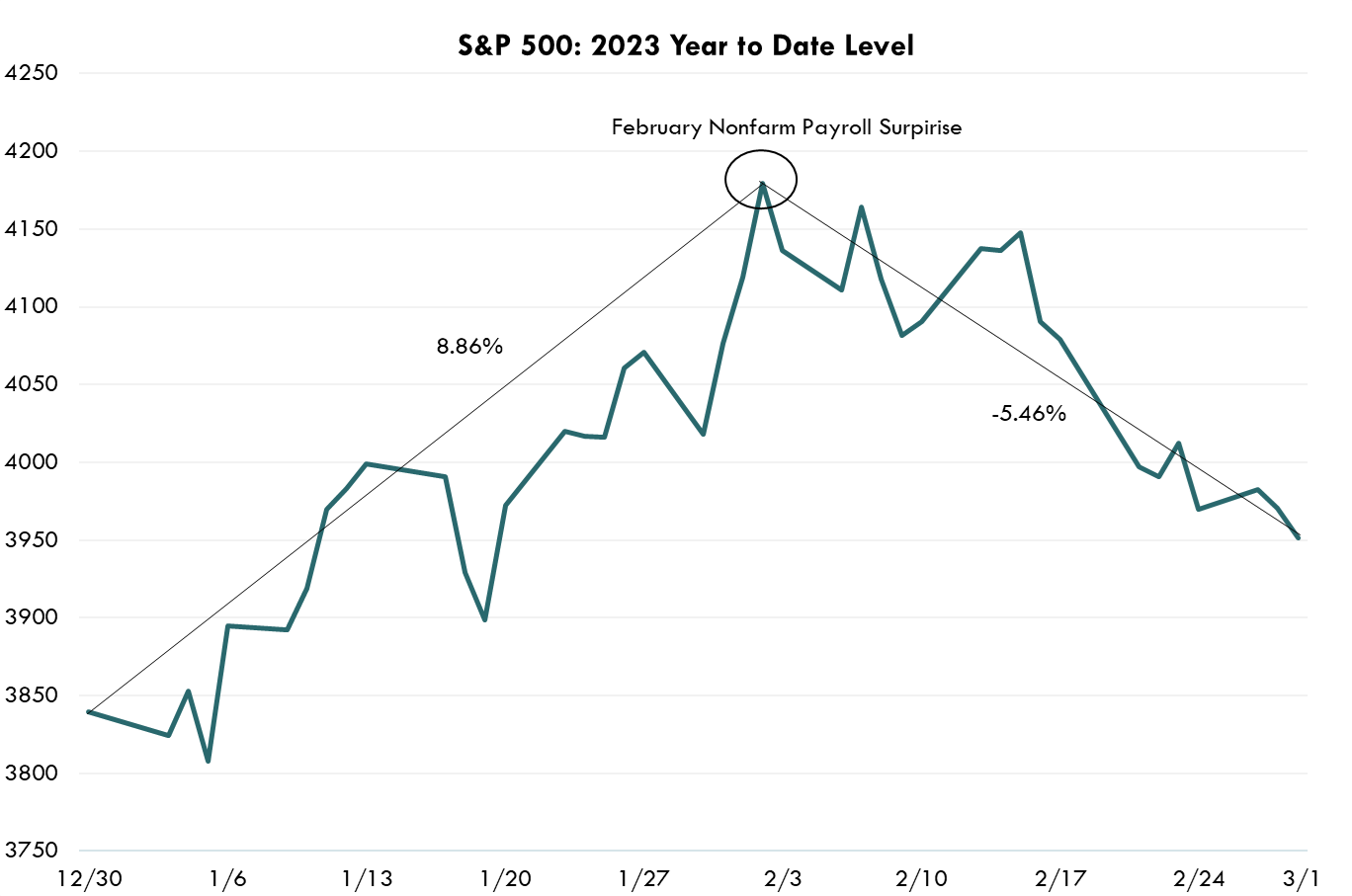

The US equity market has fallen roughly 5% from its recent 2023 highs due to stronger than expected job reports, resulting in markets repricing the probability of the Fed cutting rates in 2023. To date, the labor market has been resilient to rate hikes. In this week’s What to Watch, we explore the current health of the employment situation and the potential impact of the Fed’s historic rate hike cycle.

Nonfarm Payrolls

A direct contributor to inflation has been the imbalances in the labor market. Nonfarm Payrolls, a closely watched metric by the Fed, measures the amount of newly created jobs in the economy. The recent reading of 517k blew the median estimate out of the water by over 300k, which is not comforting news for a Fed trying slow economic growth. Subsequently, the market is down over 5% from its 2/2/2023 high, the day before to the February Nonfarm Payrolls release, and as a result, markets have begun to price in more risk of the “Higher for Longer” narrative the Fed has been telling.

Source: Bloomberg LP, SPX Index, as of 12/30/2022 – 3/1/2023

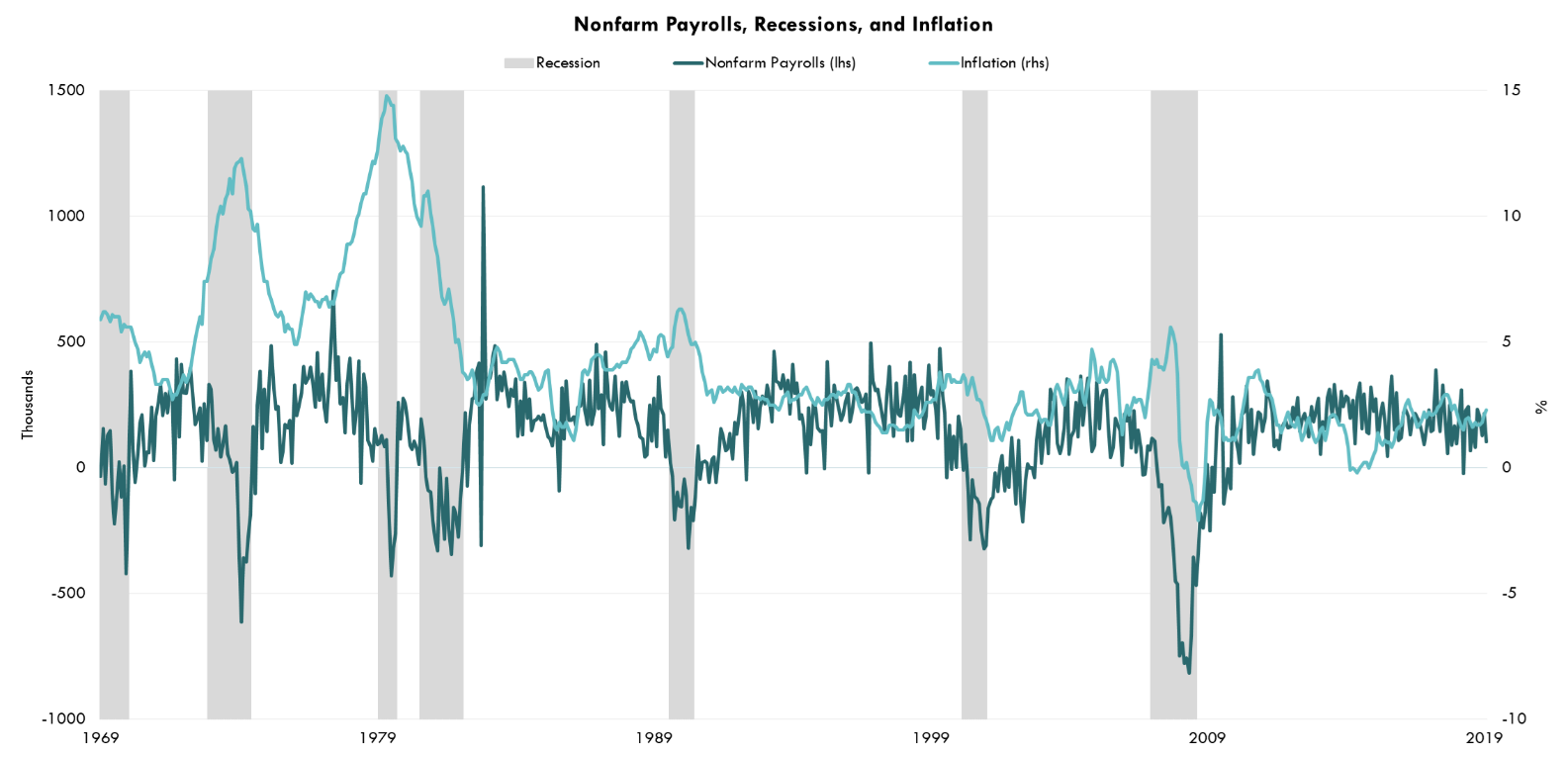

To help correct the imbalances in the labor market, the Fed would like to see Nonfarm Payrolls decrease, not increase, meaning the labor market is still too strong for the Fed’s liking. To put this in a historical perspective, January’s Nonfarm Payrolls reading placed in the 97% percentile of all releases.

Source: Bloomberg LP, NFP TCH Index, CPI YOY Index, Recession dates via NBER, as of 11/30/1969 – 12/31/2019

As seen in the chart above, inflation typically peaks when Nonfarm Payrolls bottom out. The data runs from 1969 – 2019, due to the event-driven decrease in Nonfarm Payrolls from the pandemic. Every recession has seen Nonfarm Payrolls turn negative and stay negative for the majority of the recession.

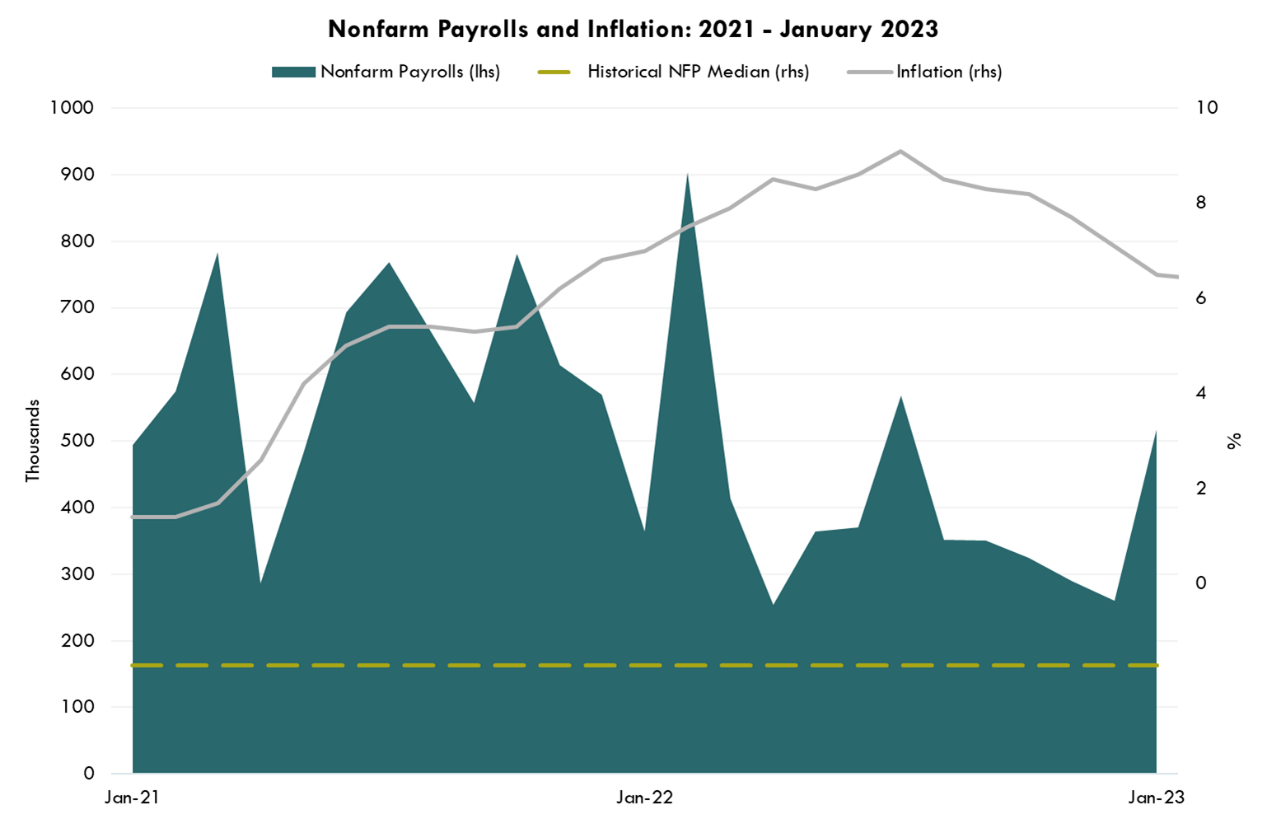

Source: Bloomberg LP, NFP TCH Index, CPI YOY Index, as of 12/31/2020 – 1/31/2023

Nonfarm Payrolls has not been negative since December of 2020, and is currently above the historical median of 163k. As we see, there is a large disconnect between the historical trends and today’s data. Overall, the data suggests the economy is producing jobs at a historic rate.

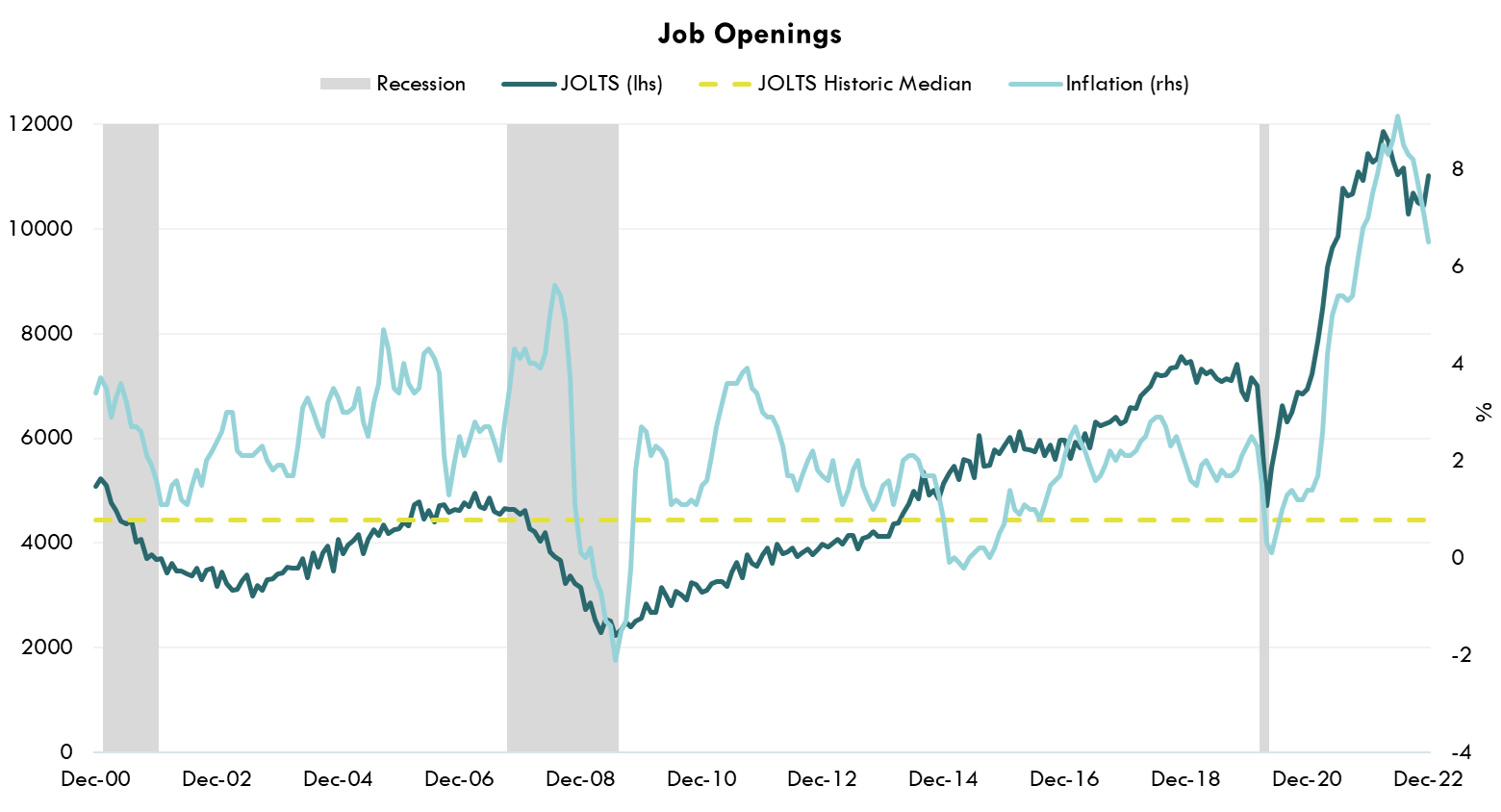

Record Job Openings Could Be Problematic

Job openings are another key metric the Fed has been focused on. The Job Openings and Labor Turnover Survey (JOLTS), which produces data on job openings, hires, and separations, has accelerated quickly to an all-time high and is currently 248% above the historical median.

Source: Bloomberg LP, JOLTTOTL Index, CPI YOY Index, as of 12/31/2000 – 12/31/2022

With a 0.57 correlation to the US Consumer Price Index (CPI), it’s clear that a main driver of inflation is job openings and the lack of slack in the labor market. Historically, peak inflation has typically not been reached until a peak in the JOLTS data. The current imbalance between supply and demand in the labor market is keeping pressure on inflation; to reach a 2% inflation rate will likely mean further softening in the labor market.

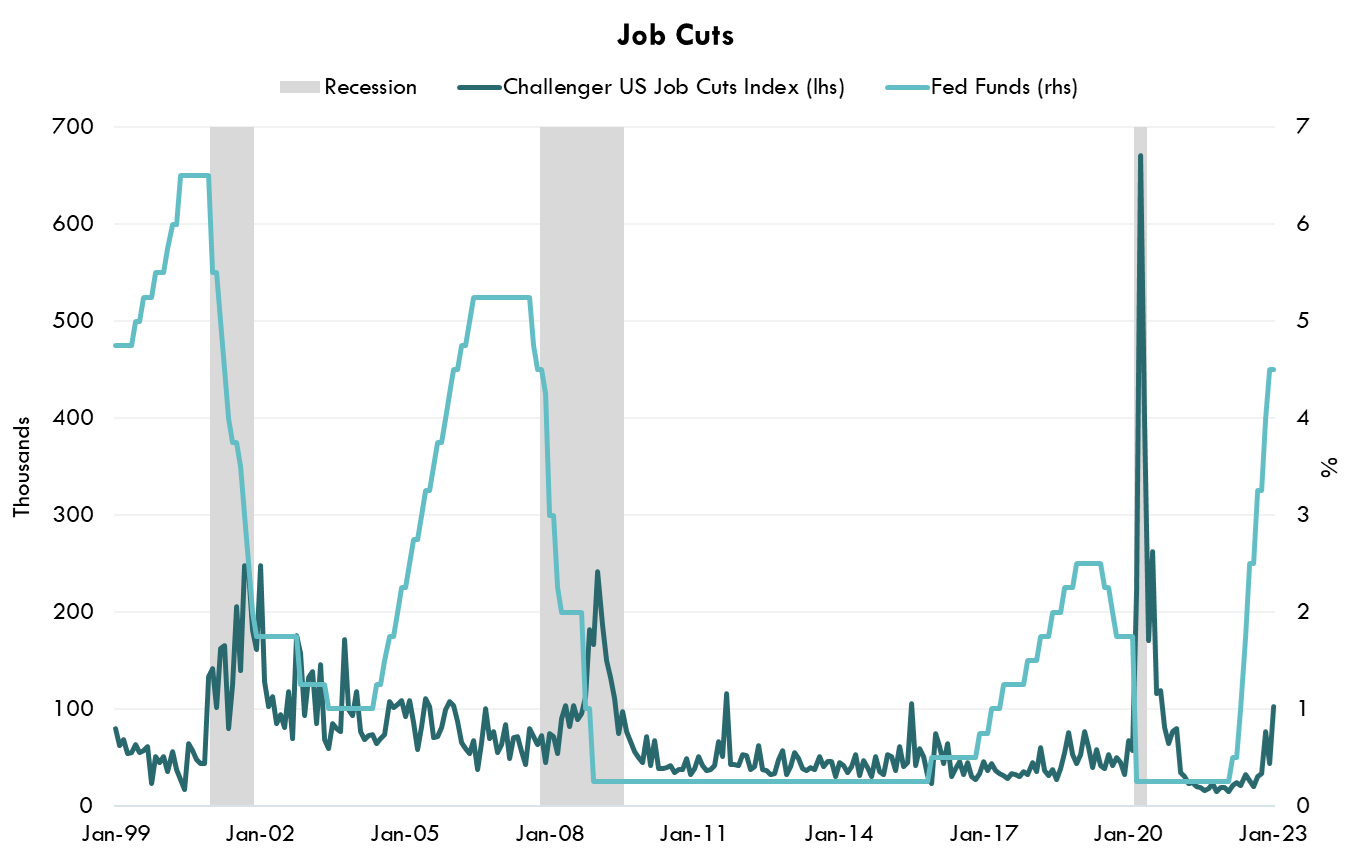

Job Cuts

On the flip side, companies announcing job cuts or hiring freezes has become a focal point in the labor landscape. Although more companies are starting to announce job cuts, it has not started to affect the unemployment rate which is at 54-year lows. Since 2022, the Job Cut Index has risen over 440% and is beginning to soften as companies prepare for the Fed to continue raising rates further into restrictive territory.

Source: Bloomberg LP, Challenger US Job Cuts Index, FDTR Index, as of 1/31/1999 – 1/31/2023

Although the Fed has risen rates at a historic clip, the labor market is most likely only in the beginning stages of feeling those effects. Historically, we see job cuts do not peak until the back half of the recession. If this trend holds true, we expect the companies to continue announcing job layoffs and JOLTS to report weaker, leading to an increase in unemployment. While this may be painful, it likely is needed to tame inflation.

What This Means

Aside from inflation data, the Fed and markets are locked into the employment situation to help determine a restrictive level for rates. While we are starting to see inflation decelerate, the employment situation is still historically strong. Until the labor market softens, due to restrictive interest rate levels, inflation is likely to remain elevated above its 2% goal. We continue to expect employment data to have a significant impact on the market, resulting in a volatile 2023.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Federal Funds rate refers to the interest rate that banks charge other institutions for lending excess cash to them from their reserve balances on an overnight basis.

Challenger US Job Cut Announcements: CHALTOTL Index, index that tracks the aggregate amount of jobs companies are cutting based on announcements made by the company.