April 11, 2023

Revisiting Inflation

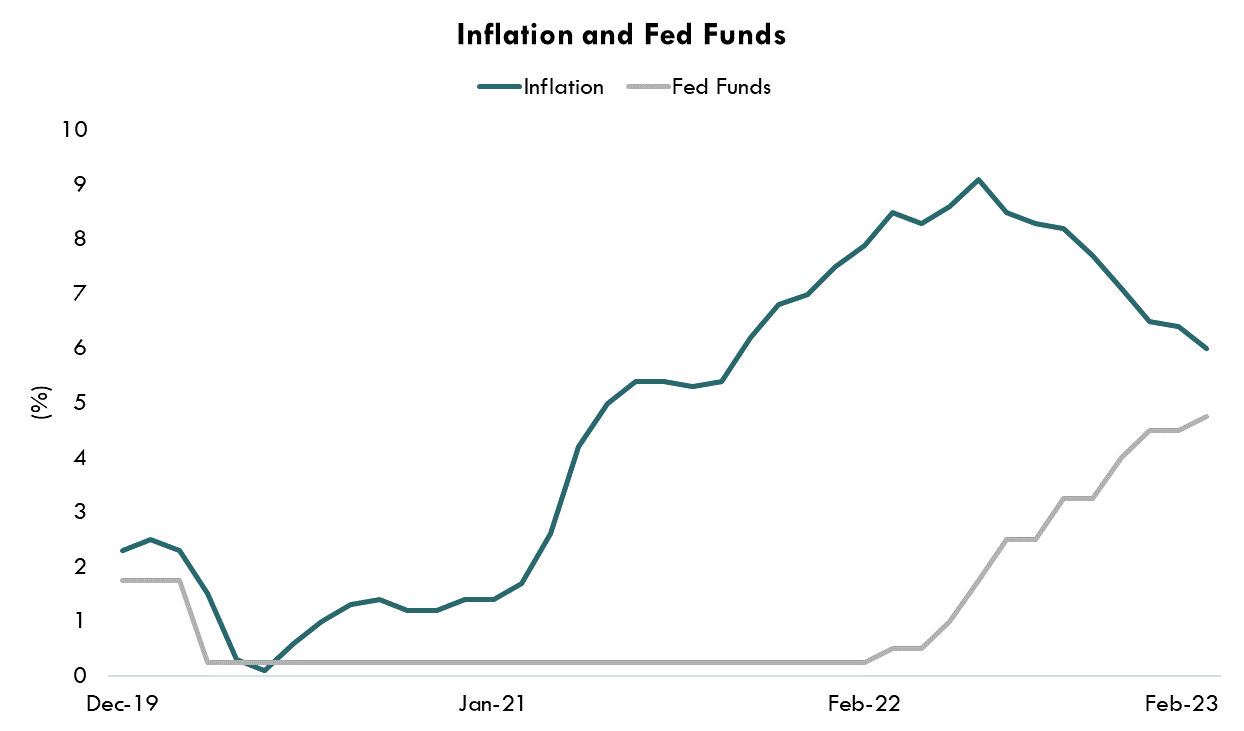

7 months ago, we released a “What to Watch – Under the Hood of Inflation”, diving into segments of the Consumer Price Index (CPI) and outlining why services were likely going to be stickier than many expected. Today we revisit the topic, specifically honing in on the trends the Fed is focused on and discuss what it all means for the markets, and the economy going forward.

Source: Bloomberg LP, CPI yoy Index, FDTR Index, as of 12/31/2019 – 2/28/2023

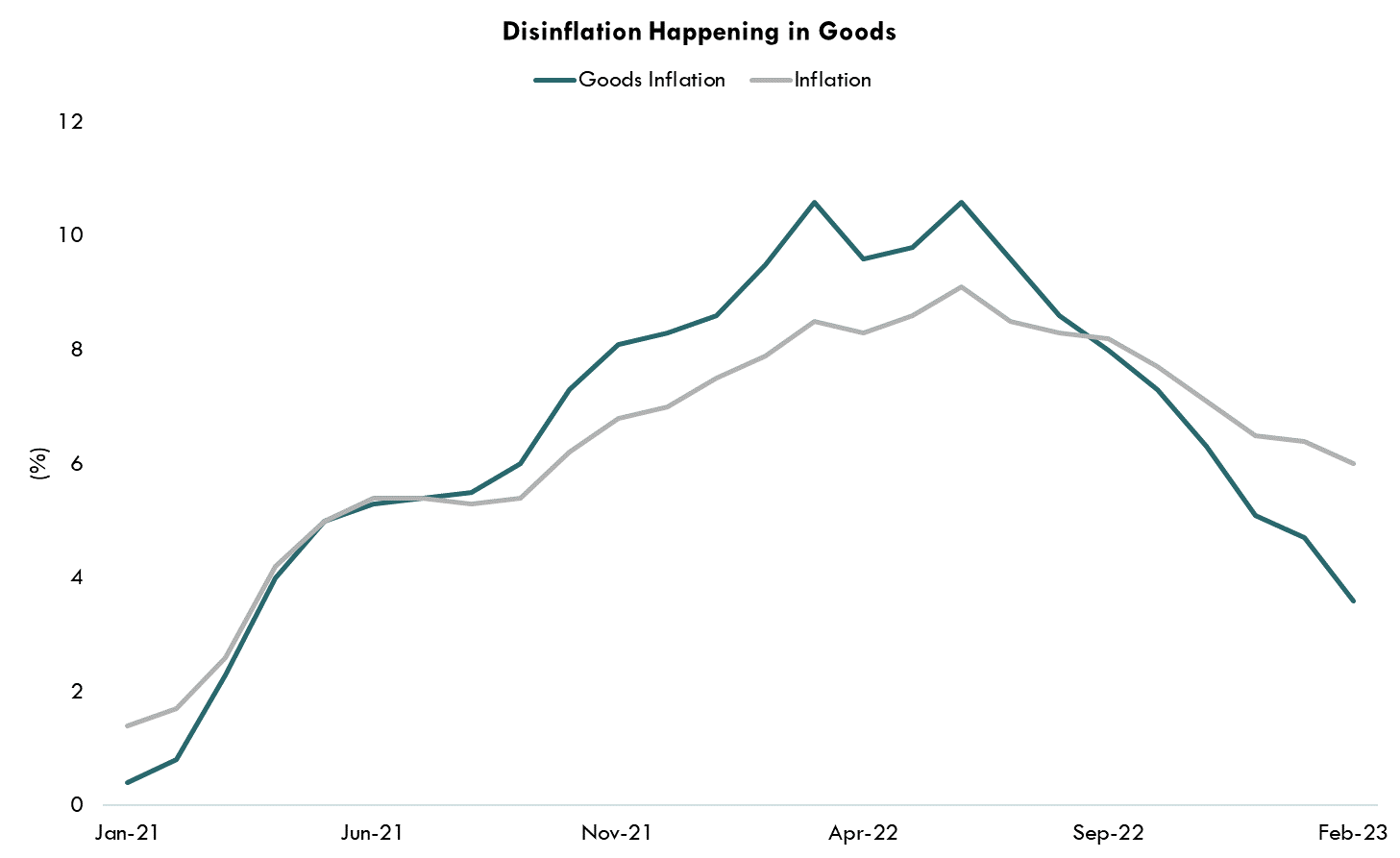

Disinflation in Goods

A positive sign for both the American consumer and the Fed is disinflation in the Goods sector. Most notably, Durable Goods prices have lowered materially as supply chain bottlenecks begin to ease and China’s economy remains open.

Source: Bloomberg LP, CPI YoY Index, as of 1/31/2021 – 2/28/23

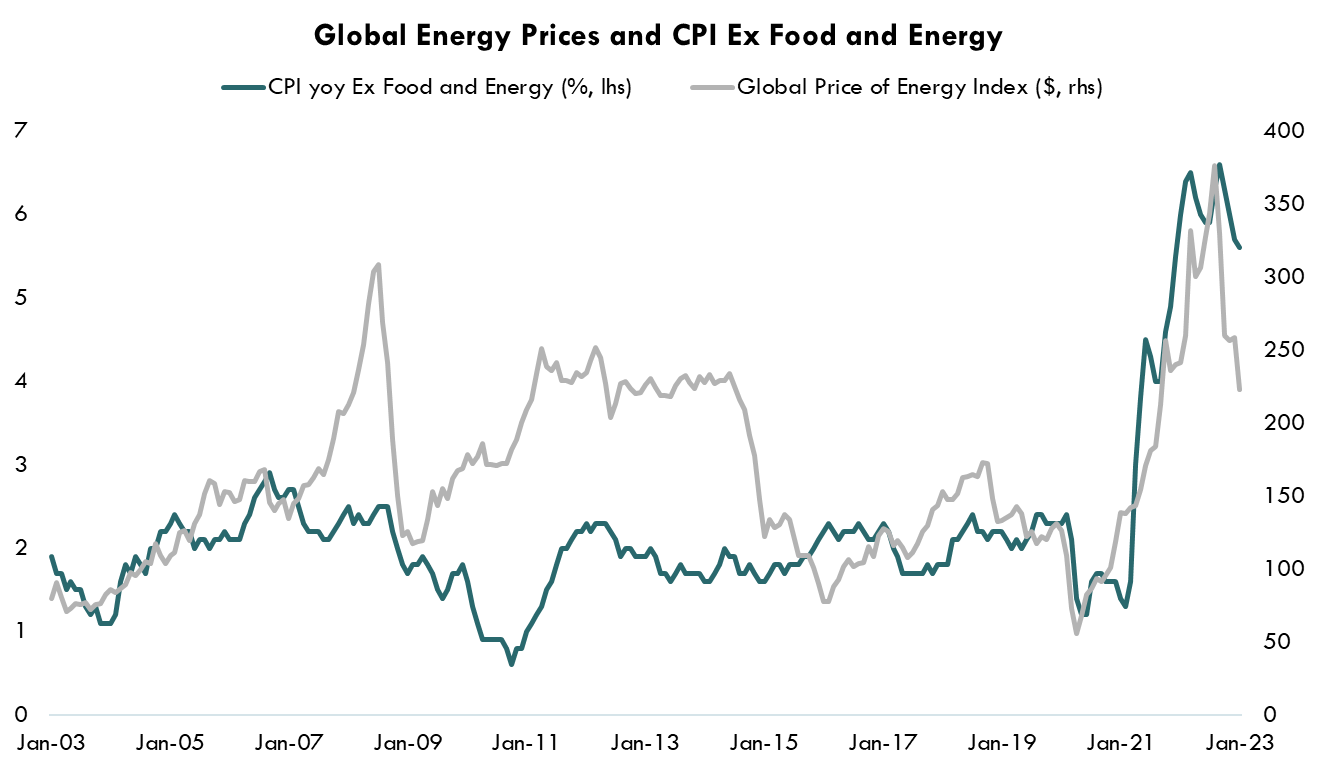

However, a volatile member of this sector is energy. Energy costs have a major and direct impact on the American consumer and also impact other components of the CPI basket. While the Biden Administration has been artificially holding costs down by draining strategic reserves, OPEC+ recently announced it would cut oil production by 1.15 million barrels per day. This will most likely cause in a jump in oil, energy, and gas prices, resulting in higher inflation in the sector and an added burden on the consumer. Overall, while the Fed’s inflation gauge strips out the volatile energy sector, the impact of higher energy prices are felt well beyond the sector. The chart below highlights this dynamic, examining the relationship between energy costs and the prices of other goods and services over time.

Source: Bloomberg LP, ZRIOACUR Index, CPI YoY Index, as of 12/31/2021 – 2/28/2023

Overall, the steady disinflation in goods has been encouraging, but should not be taken for granted. Investors need to be aware of the potential impact higher energy prices may have across various other sectors.

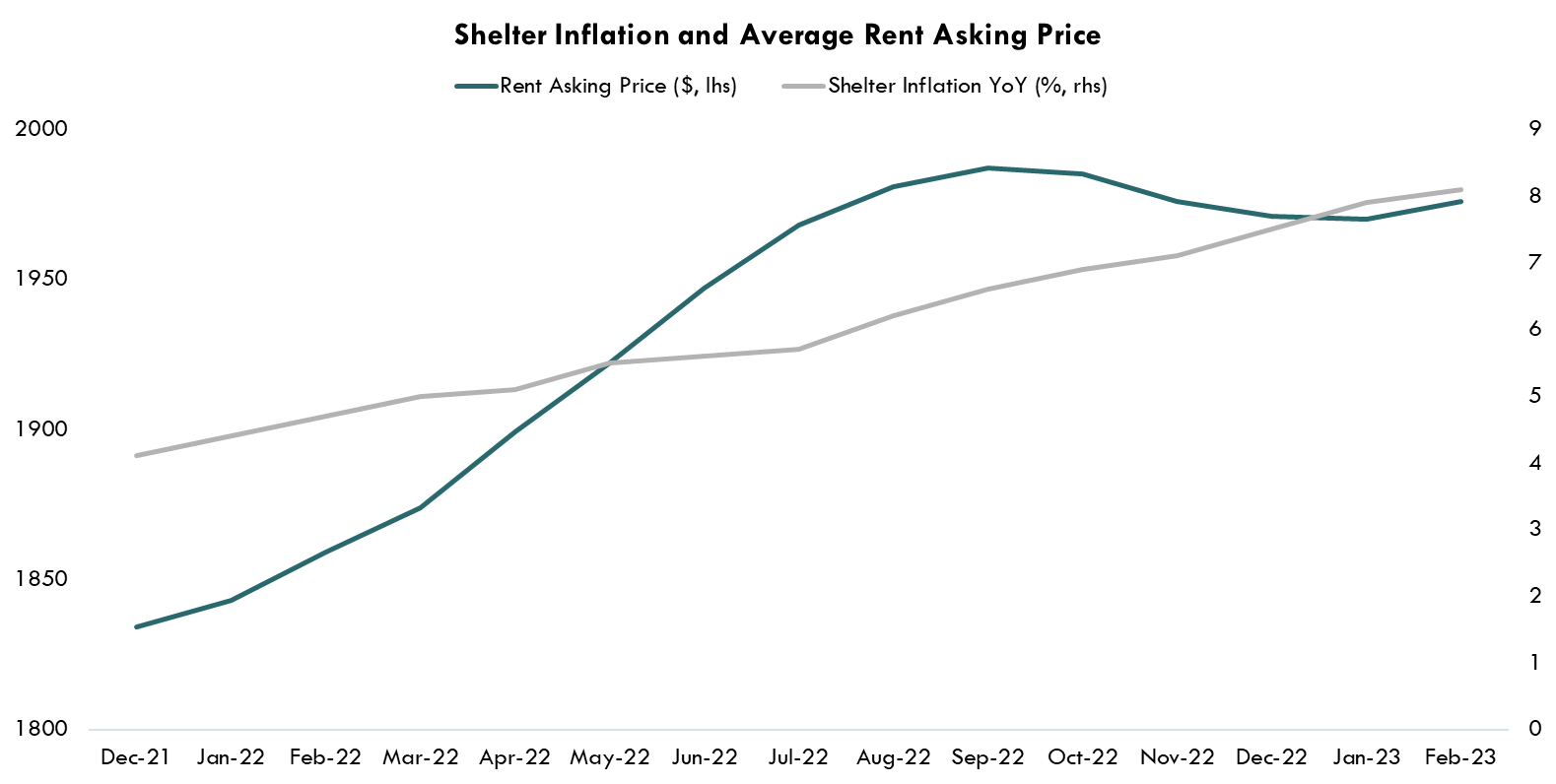

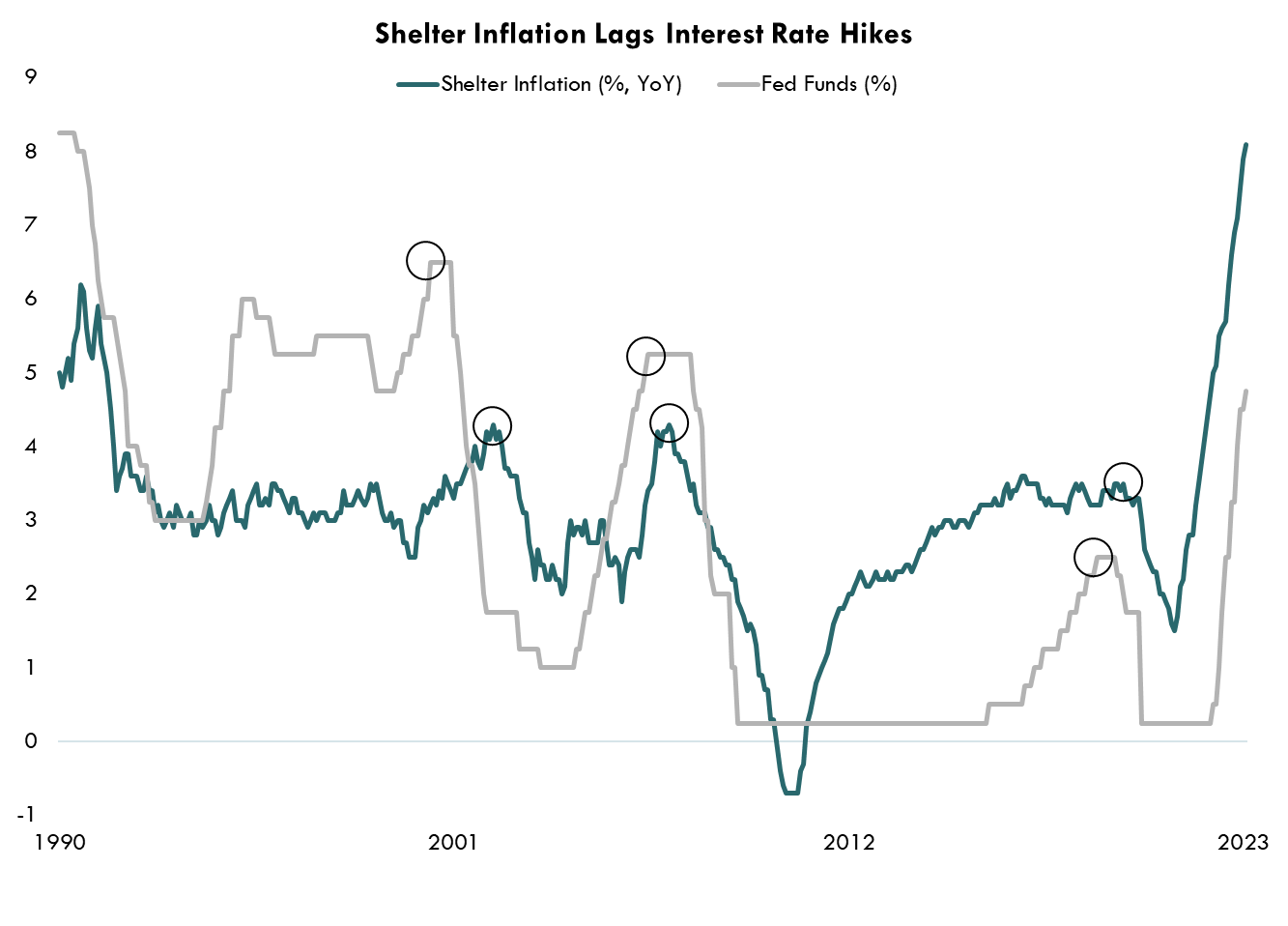

Housing Services Lags

The peak in shelter inflation has yet to show up in the inflation data, but it should be coming soon. Shelter data always lags and will not carry much weight in determining the Fed’s next move.

Source: Bloomberg LP, ZRIOACUR Index, CPI YoY Index, as of 12/31/2021 – 2/28/2023

In the past 3 Fed Hike cycles, shelter inflation did not even peak until 13 months after the peak in the Fed Funds Rate was reached. As such, we expect Shelter inflation to slowly come back down and have little impact on the Fed or overall level of interest rates.

Source: Bureau of Economic Analysis, Bloomberg LP, FDTR Index, as of 1/1/1990 – 2/1/2023

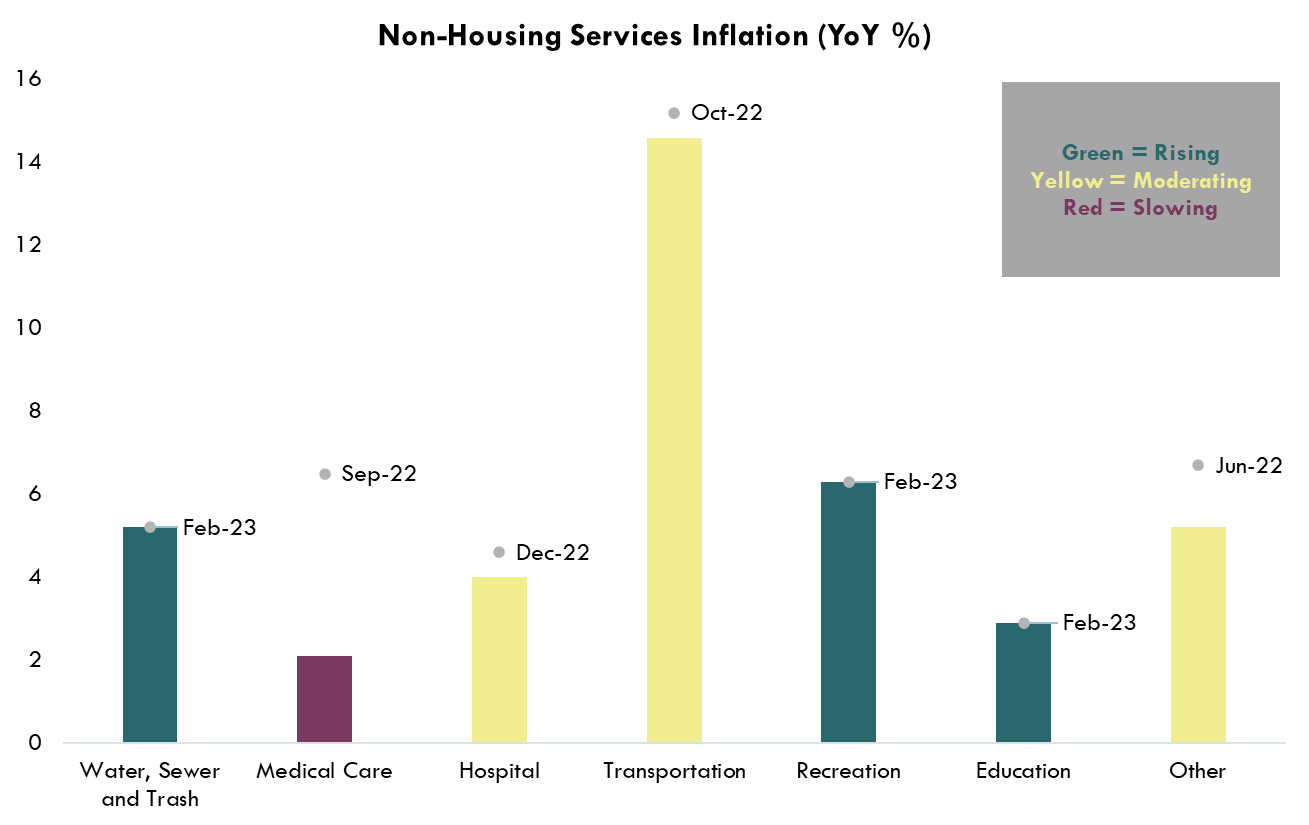

More Work Needed in Non-Housing Services

Non-Housing services still hasn’t experienced much disinflation, and this is important. This is the area the Fed will be laser focused and will likely have a big impact on future rate decisions. Non-Housing services are more sensitive to changes in unemployment and wage growth, and the resilience of the labor market is likely why sustainable gains have not been made. Currently, as shown in the chart below, six out of the seven sub-sectors in non-Housing services are either rising, or moderating slightly.. Again, this can be attributed to an imbalance of supply and demand in the labor force. Should labor market rebalancing accelerate, we would expect to see many pockets begin to move down, but we are not there yet.

Source: Bloomberg LP, CPI yoy Index, as of 12/31/2021 – 2/28/2023

Bottom Line

While the overall disinflation process has begun, there are still areas that need work. Non-housing services will be a key area of focus and the impact of higher energy costs will need to be monitored.

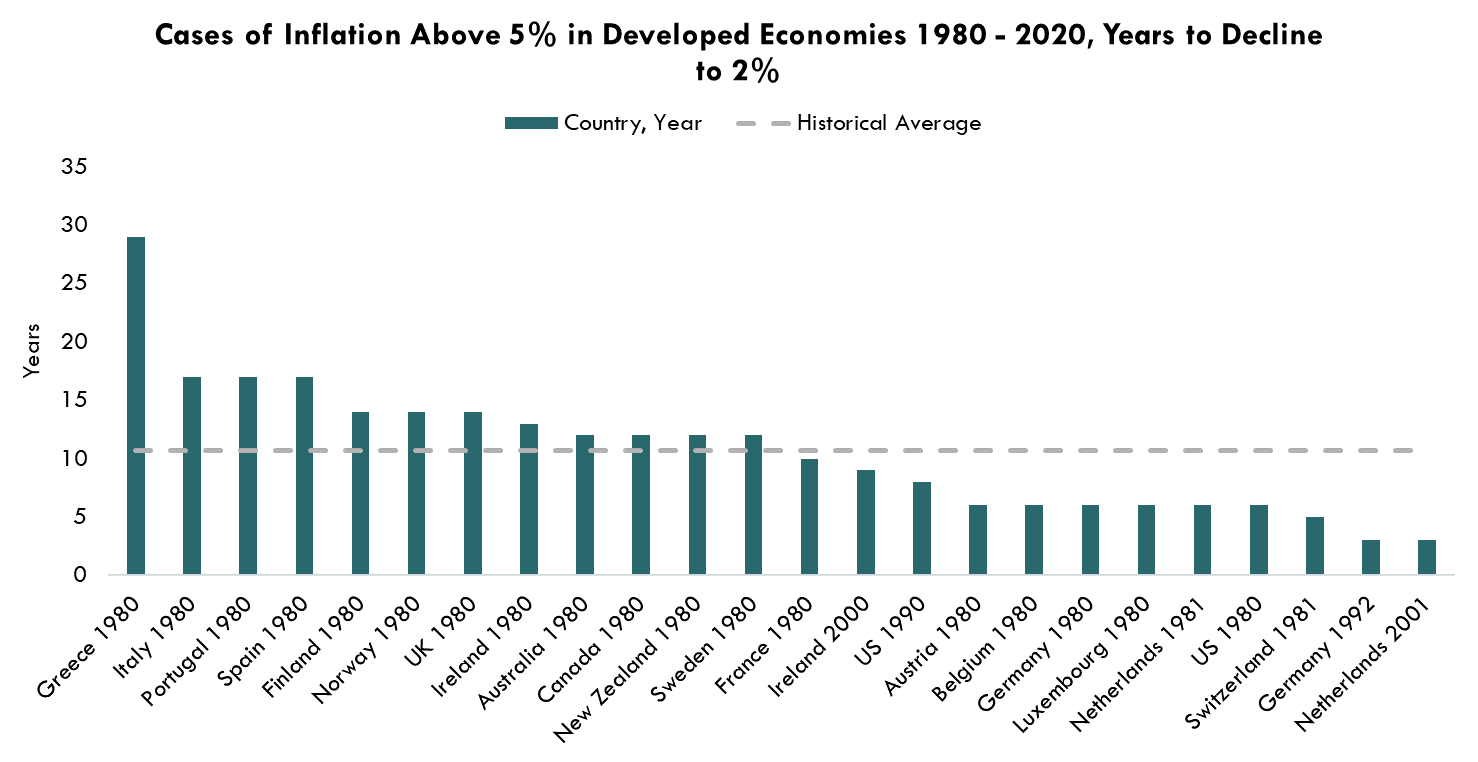

The Fed’s messaging has been consistent from the start: it will be a long road to get inflation back down to its 2% goal. While we don’t believe they need to take rates much higher, we do believe they will have to leave rates higher for longer than expected. Looking at historical data of developed countries where core inflation has surpassed 5%, on average it has taken 10.71 years to bring inflation back down to 2%. Disinflation can take time, and that likely means investors need to be patient.

Source: IMF.com, 1980 - 2020

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Federal Funds rate refers to the interest rate that banks charge other institutions for lending excess cash to them from their reserve balances on an overnight basis.